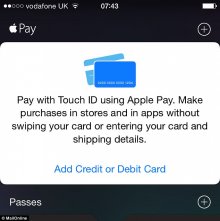

Customers in the UK can now use Apple Pay to buy goods and services in high-street stores with a simple wave of their phone or watch. iPhone owners must have the latest version of the iOS software 8.4 to use the service. Card details can then be added in Apple's Passbook app (pictured)

Customers in the UK can now use Apple Pay to buy goods and services in high-street stores with a simple wave of their phone or watch. iPhone owners must have the latest version of the iOS software 8.4 to use the service. Card details can then be added in Apple's Passbook app (pictured)

Many of the biggest names on the high street, including Costa Coffee, Starbucks, Marks & Spencer, Waitrose and Boots have signed up to the scheme.

However, Apple customers took to social media to express frustration that their banks do not yet offer the new payments service.

The fact that HSBC and its subsidiary First Direct, with their 16million customers, are not yet offering Apple Pay is particularly surprising as they featured in the launch material issued by the US tech giant. Rumours that the delay was due to technical problems were denied by the bank. Customers of Lloyds, Halifax, Bank of Scotland, TSB and the M&S Bank will have to wait until autumn at the earliest to use Apple Pay. Frustrated customers took to Twitter to complain.

Tim Davies posted: ‘So Apple Pay is out in the UK but none of my HSBC cards work.’

Tim Davies posted: ‘So Apple Pay is out in the UK but none of my HSBC cards work.’

James Brenchley complained: ‘Pretty hacked off that my @firstdirect account won’t work with #ApplePay today, despite them claiming to be a launch partner.’

Pinar Ozcan, of Warwick Business School, said the fact key banks are not offering Apple Pay immediately will harm its reputation. There are already some 250, 000 till points across the country which accept Apple Pay.

The Apple Pay system only works in conjunction with the iPhone 6 and iPhone 6 Plus and the Apple Watch. To make a purchase shoppers simply wave their iPhones or Watch over a scanner at the till. It is then verified by a thumbprint scanner on their device.

A spokesman for HSBC said: ‘We always planned to go later this month.’ Barclays said yesterday it plans to offer Apple Pay, but it did not put a date on it.

A spokesman for HSBC said: ‘We always planned to go later this month.’ Barclays said yesterday it plans to offer Apple Pay, but it did not put a date on it.

The banks and building societies that are offering Apple Pay with immediate effect are NatWest, Royal Bank of Scotland, Ulster Bank, Santander and Nationwide.

Apple Pay launched in the US last year and tourists, for example, can already use Apple Pay in London.

The UK launch announcement was made by vice president of Apple Pay, Jennifer Bailey, at its annual Worldwide Developer's Conference in San Francisco in June.

The UK launch announcement was made by vice president of Apple Pay, Jennifer Bailey, at its annual Worldwide Developer's Conference in San Francisco in June.

HOW TO SET UP APPLE PAY

To use Apple Pay, iPhone owners need to update to the latest version of the iOS software 8.4.

This is accessed in the Settings menu, under General and Software Update.

To update, make sure the phone is connected to Wi-Fi, plugged into the mains and all data on it has been backed up.

Once updated, go to the Passbook app and the option to set up Apple Pay should appear at the top. Click 'Add Credit or Debit Card'.

Users can then manually enter their credit or debit card details, or take a photo of the front of the card using the phone's camera.

Once a card is connected, the phone's NFC chip can be used on contactless card readers in stores, in tube stations and on buses where available.

It works in the same way as a contactless card and the money is deducted from the connected account automatically.